The adjuster is not on your side!

The larger your personal injury claim, the more likely the adjuster contacting you will be nice and friendly. The smaller your claim appears to be to them, the more likely they may be rude and abrupt.

Suppose an insurance company perceives that they have a significant loss exposure. In that case, the adjuster will most likely establish rapport with you and will seem helpful and fair- until the money is discussed!

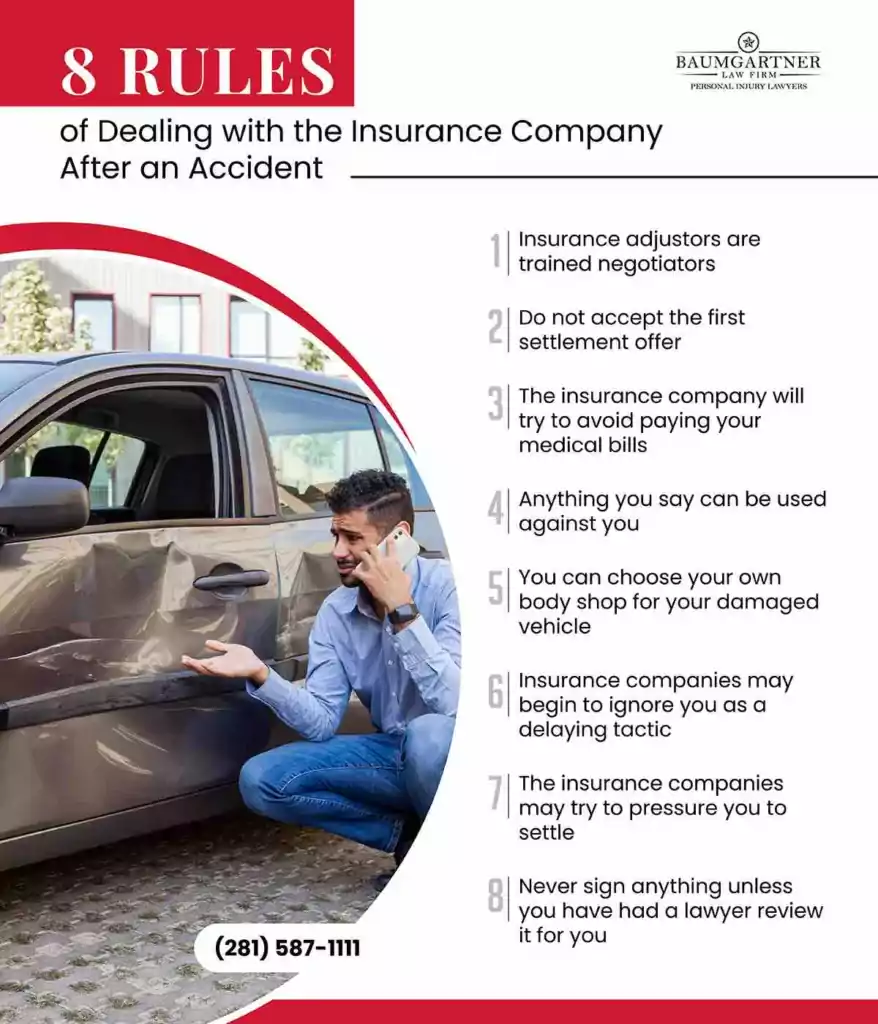

One reason for significant damage claims that the adjuster may be friendly and even appear helpful is that they may attempt to discourage you from hiring a car wreck attorney. Some adjusters have said such things as:

“we accept responsibility “,

“you don’t need to hire an attorney,” or

“they’ll just take part of the money.”

There is a REASON the insurance company discourages you from getting representation, and it’s not to benefit you!

*Pro Tip

-Hire the best attorney you can early.

Insurance Company Tactic: Leaving the impression that the adjuster will fairly address your damages. Generally, the innocent victim mistakenly believes that when the insurance adjuster says things like “we accept responsibility,” it means that their offer for damages will be fair.

Frequently, it is only after the adjuster discusses compensation that the personal injury victim understands that they need an attorney. Unfortunately, that usually happens many months after the accident. Many things that should have been done to document the claim have not been done because the victim expected fairness from the insurer.

*Bonus tip:

Accepting responsibility does not mean a fair or reasonable settlement offer!

What you say can hurt you!

Insurance adjusters will want to take recorded statements from a personal injury victim soon after a car crash. Some may even suggest they cannot process a claim UNLESS you give a statement. This is not true in Texas for injury claims made to the other party’s insurer!

Also, be wary of early offers or settlements when medical bills are “estimated.” This lets the insurance company off the hook and can be a big mistake. A recent court case in Texas upheld an oral settlement agreement.

*Pro Tip:

-We recommend that you give no recorded statement to an adverse adjuster.

However, if you give a recorded statement to an adverse adjuster, be very careful what you say.

Insurance adjusters have been trained to take statements from personal injury victims. Do not let them put words in your mouth.

A question such as “When did you first see the other vehicle?” is a loaded question because it assumes that you saw the other victim’s vehicle before impact.

Another area of conversation that comes up and recorded statements is the extent of injuries. Sometimes, a victim may not know the extent of their injuries until a day or two or even later. Other times one area hurts so badly that other medical problems are not identified. Avoid giving statements while taking medicine.

*Bonus tip:

If you give a recorded statement to the adverse adjuster, follow these guidelines

1. Never volunteer information.

2. Be truthful and concise

3. If you don’t know, don’t guess.

4. Qualify your answers when appropriate.

Watch out for insurance company tactics.

Adjusters often will seek to imply the claim is of little value or less than it might be. The adjuster may try to imply they have problems with the medical or that they feel you are partly to blame. Subtle statements about a claim can reduce the expectations of the victim.

Don’t fall for it. Watch out for the tactics, whether the company is State Farm, Allstate, Geico, or another.

Read More: How to Deal with a Low Settlement Offer(Opens in a new browser tab)

*Pro Tip:

-Talk with an experienced attorney about the value of your case, not the adjuster!

Understand that the adjuster will seek to pay little to settle the claim. If an adjuster can settle a case for pennies on the dollar, their supervisors will praise them.

If you are getting negative vibes from the adjuster, it may signal you need to retain an attorney. Numerous studies have shown folks represented by reputable attorneys net more money than those trying to represent themselves.

Pointing the Finger at You:

Seeking to apportion responsibility when the accident was caused by their insured. Using this tactic, many adjusters seek to discount the damages their insured has caused by claiming that the innocent victim was partly responsible. This is usually done even though the accident report shows the crash was caused by the negligent driver they insured.

Disputing your Medical Care:

Discounting medical bills and expenses – adjusters use this tactic to reduce the amount they need to pay for medical bills and expenses. While Texas law reduces the amount the victim collects to amounts that are “paid or incurred,” many adjusters seek to discount the paid or incurred bills by citing such things as excessive, unnecessary, or disallowed.

Occasionally the insurance company will send out the bills for an “audit,” where a friendly company suggests discounts on every bill they send.

These are only a few common trade tricks some insurance adjusters use to reduce the value of the claim they must pay. Unfortunately, personal injury victims are usually at a disadvantage because they are not used to the claims procedure and processes and don’t understand the adverse positions of the parties.

Personal injury victims are encouraged to seek consultations with an experienced and reputable personal injury attorney before they attempt to deal with an adjuster regarding a personal injury claim.

Avoid settlement traps!

A few of the most common settlement traps are:

- Quick settlements

- Estimated future medical settlements

- Pressured settlements

- Pre-diagnosis settlements

- Disregarding medical liens.

Some adjusters attempt to pressure a personal injury victim into settling early, often before a clear diagnosis has been made of the injuries. Many victims have fallen prey to this tactic, and the consequences can be severe as the risk of a serious injury shifts from the insurance carrier to the victim.

It is a bad idea to settle before you know the extent of your injuries. Insurance companies do not pay medical bills while they are ongoing, and attempts to entice you into a quick settlement so you can pay your medical bills is almost always a bad way to go.

Quick settlement offers with estimated future medical. Using this tactic, an adjuster will seek to close the file early and estimate medical expenses that may be incurred. Unfortunately, the insurance company also requires a full release of liability. If the damages turn out to be more serious or the medical bills are excessive, the innocent victim is left holding the bag with no real recourse.

With big impacts such as getting hurt in an 18-wheeler accident, make sure that your doctor has released you and are comfortable that you have healed before considering a settlement.

*Pro Tip:

-Consider potential medical paybacks if health insurance paid some amount or a hospital filed a lien.

Delays can hurt your case!

A delay in seeking medical treatment can damage a personal injury claim. The longer you wait for medical treatment, the larger gaps in the treatment will make the potential for settling your case out of court difficult. And long delays between treatments can make it much more difficult to recover fair money from a jury.

How long your injury case will take often revolves around your medical treatment.

*Pro Tip:

-Follow your doctor’s orders and do not delay getting treatment.

If you cannot afford the treatment needed, speak with your doctor or a personal injury lawyer about funding options for ongoing medical bills.

Delays in finding witnesses or necessary crash information can also hamper a case.

Take advantage of free consultations.

Most reputable personal injury attorneys offer free consultations to personal injury victims. Whether hiring an attorney or considering handling a car accident claim, taking advantage of a free consultation is a good idea, and there is no downside to taking advantage of it. Before you deal with State Farm, Geico, Progressive, or any other car insurer after an accident, talk with a lawyer.

The Texas Department of Insurance offers these tips for dealing with an auto accident claim.

*Pro Tip:

-Speak with several attorneys to find one you are comfortable with.

*Bonus tip:

Talk with a lawyer in the county of the crash and not out-of-state attorneys. If you were injured in Houston, TX, look for a local attorney.

The more serious your injury, the more likely you need a lawyer.

Personal injury claims include more than just negotiating a number with the insurance company. The more serious your injuries and the larger your medical bills, the more likely you will need a personal injury attorney to assist you.

If you have health insurance, your health insurance company will probably have their hand out and want to be paid back for the medical bills.

If your hospital bill hasn’t been paid, there probably is a hospital lien that will take the first money out of any settlement. Retaining an experienced and successful personal injury attorney for a more serious injury is a better choice.

Insurance adjusters attempt to discourage you from getting an attorney for a reason- to save money. Studies have shown those represented by competent counsel net more money.

However, if you want to represent yourself, here are a few secrets you should know.

*Pro Tip:

-The larger the case, the more your choice of attorney matters; always research attorneys before you hire one.

Do not volunteer information to the adjuster, but tell your attorney everything.

Causal talk with any adjuster should be avoided. This includes discussing your injuries, background, prior claims or injuries, and how the accident happened.

The most innocent of comments can open up issues and come back to bite you if you are not careful.

If you hire a lawyer to handle your case, tell them everything, and let the attorney do the talking for you. Do not make the mistake of thinking keeping something from your lawyer will help you; it will not and will hurt or kill your claim if your lawyer is unaware of the facts.

Many folks do not tell their attorneys information they think may hurt their case. They don’t know the defense attorneys most likely already know the facts. This is particularly true with prior injuries or accidents.

*Pro Tip:

-Tell your attorney everything because it is the only way they can effectively help you.

Contact a Houston Personal Injury Lawyer at Baumgartner Law Firm for Help

Contact a top-rated Houston personal injury lawyer at Baumgartner Law Firm for more information by calling (281) 587-1111.

Related Posts:

How to Successfully Deal With Insurance Adjusters

Top 10 Insurance Company Tricks for Car Accident Victims

Houston Personal Injury Settlements Fact vs. Fiction

Why is the Insurance Company Low Balling Me?

What to do When The Adjuster Won’t Return Your Calls

Why Do Some Injury Claims Take Longer to Settle?

Should I Accept a Settlement Offer from the Insurance Company?

5 Things You Need to Know About Going to the Emergency Room After an Accident