The consequences of accidents involving 18-wheelers can be devastating. Understanding Texas Commercial Truck Insurance Requirements for 18-wheelers is crucial, as these massive vehicles can cause significant damage and severe injuries to those involved.

If you find yourself in a situation where you’ve been injured in a collision with an 18-wheeler, it’s crucial to understand the insurance requirements in Texas for 18-wheelers. The easiest way is to hire a Houston trucking accident lawyer right away.

Federal regulations governing truck drivers provide the minimum standards for safe conduct in the trucking industry, and violations often serve as strong evidence of negligence following an accident.

As in most states, commercial vehicles, including 18-wheelers, are required to carry more insurance coverage than regular passenger vehicles in Texas. This is to ensure that victims of accidents involving these large trucks are adequately compensated for their injuries and damages. Commercial truck insurance details various coverage options and minimum insurance requirements necessary for small and large trucking operations.

Injured in a Commercial Vehicle Accident?

Overview of Texas Commercial Truck Insurance Requirements for 18-Wheelers

Commercial auto insurance is vital for any business operating vehicles in Texas for work purposes. This type of insurance is designed to cover the costs associated with accidents involving business-owned vehicles. Whether it’s a delivery van, a company car, or an 18-wheeler, commercial auto insurance helps pay for medical bills, legal fees, and other related expenses if one of your business vehicles is involved in an accident.

In Texas, having commercial auto insurance is not just a good idea—it’s a legal requirement. This insurance ensures that businesses can continue to operate smoothly even after an accident without facing crippling financial losses. For businesses that rely heavily on their vehicles, such as trucking companies, having robust commercial auto insurance is crucial to protect against the high costs of potential accidents and liabilities.

Proof of Liability Insurance

All drivers in Texas must have proof of auto liability insurance for each vehicle. Truckers are no exception. If you are in an accident with a semi or other commercial vehicle, you must provide the insurance coverage information to the investigating officer.

Minimum Coverage For Commercial Vehicles

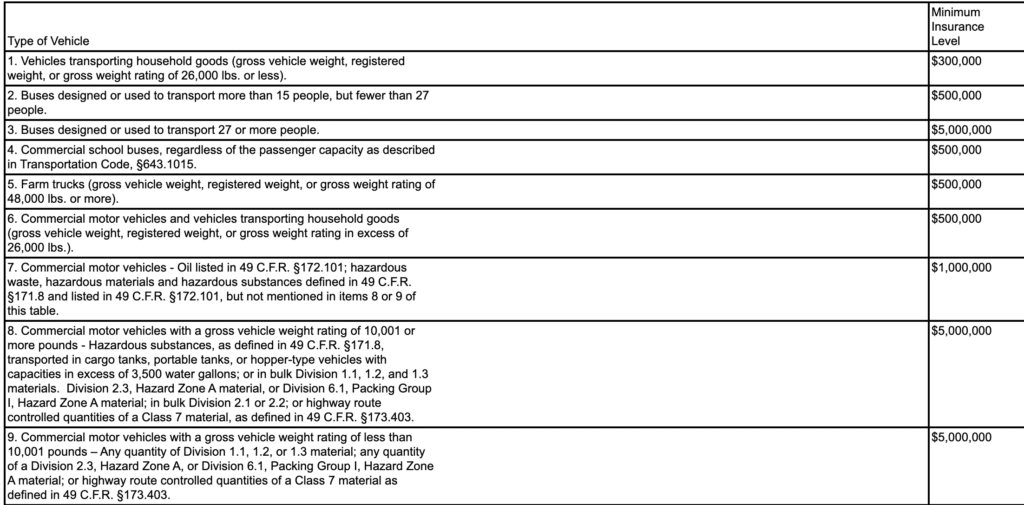

Both Texas law and federal law require minimum limits for commercial vehicle insurance for commercial vehicles. Truck drivers and trucking companies must have at least the specified minimum coverage. Coverage requirements vary depending on the type of vehicle, its intended use, and the items it carries.

According to the Texas Department of Insurance and federal law, commercial motor vehicles with a gross weight rating of 26,001 pounds or more and engaged in interstate commerce must have a minimum liability insurance policy of $750,000.

This policy covers bodily injury and property damage caused by the negligence of the truck driver or the trucking company. Limits increase for certain types of loads, such as oil or hazardous material.

Texas Intrastate Trucking Insurance Minimum

PROOF OF LIABILITY INSURANCE

Trucks engaged only in intrastate business can carry less insurance in Texas. For instance, a commercial vehicle weighing less than 26,000 pounds that transports household goods can have only $300,000 in liability coverage. While small buses must have $500,000 of coverage anSmalles $5,000,000., and large buses must have $5,000,000

A commercial vehicle transporting household goods and weighing over 26,000 pounds must have at least $500,000 in liability coverage. Here are the current minimum limits in Texas.

Types of Insurance Coverage

Commercial auto insurance policies in Texas typically include several types of coverage to protect your business from various risks:

- Liability Insurance is essential because it protects your business if one of your vehicles causes an accident. It helps pay for the accident’s property damage and medical expenses, ensuring that your business is not financially devastated by a single incident.

- Collision Coverage: Regardless of who is at fault, collision coverage helps pay for damage to your vehicle if it is involved in an accident. This is particularly important for businesses that rely on their vehicles for daily operations.

- Comprehensive Coverage: This type of insurance covers damage to your vehicle that is not caused by a collision. This includes incidents like theft, vandalism, or natural disasters, providing a broader range of protection for your business assets.

- Personal Injury Protection (PIP) Coverage: PIP coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault in an accident. This ensures that medical bills are covered promptly, reducing the financial burden on your business.

- Uninsured/Underinsured Motorist Coverage: If you are involved in an accident with someone who does not have insurance or does not have enough insurance to cover the damages, this coverage helps pay for the resulting costs. This is crucial for protecting your business from uninsured drivers on the road.

By understanding and selecting the right types of coverage, you can ensure that your business is well-protected against various risks.

Excess Coverage

It’s essential to note that this minimum insurance requirement applies to both the trucking company and the commercial truck owner. If the truck driver is an independent contractor, they may have liability insurance in addition to the company’s. Larger companies can also carry excess coverage, such as general liability insurance, in addition to their primary policy.

The insurance requirements may be higher in certain cases, such as when the 18-wheeler is transporting hazardous materials. The specific details regarding insurance coverage for hazardous materials can be found in the Texas Transportation Code.

Insurance Costs and Premiums

The cost of commercial auto insurance in Texas can vary widely depending on several factors. One of the primary factors is the industry in which your business operates. Different industries have different levels of risk, which can significantly affect insurance premiums. For example, a trucking company may face higher premiums due to the increased risk of operating large commercial trucks.

The types of vehicles your business uses also play a crucial role in determining insurance costs. A fleet of delivery vans may have different insurance needs and costs than a fleet of 18-wheelers. Additionally, factors such as your business’s annual revenue, credit score, and driving record can influence the cost of your insurance coverage.

On average, commercial auto insurance in Texas costs around $218 per month or $2,610 annually. However, these costs can vary based on your specific business needs and circumstances. By understanding the factors influencing insurance premiums, you can make informed decisions to manage your insurance costs effectively.

Commercial Vehicle Accidents Are Usually Severe

It’s essential to note that this minimum insurance requirement applies to both the trucking company and the commercial truck owner. If the truck driver is an independent contractor, they may have other liability insurance besides the company’s insurance. Often, larger companies can also carry excess coverage that is stacked on top of the primary policy.

The insurance requirements may be higher in certain cases, such as when the 18-wheeler transports hazardous materials. Details regarding insurance coverage for hazardous materials can be found in the Texas Transportation Code.

While these insurance requirements may seem sufficient, the reality is that accidents involving 18-wheelers often result in catastrophic injuries and damages that far exceed the minimum coverage limits. Victims may require extensive medical treatment, rehabilitation, ongoing care, and compensation for lost wages, pain, and suffering.

Consult a Skilled Trucking Accident Law Firm ASAP

If you have been involved in an accident with a commercial vehicle, such as a big rig, contact us to consult with a skilled personal injury attorney who has experience handling truck accident cases.

They can investigate the accident, gather evidence, and negotiate with the insurance company on your behalf to ensure you receive the full and fair compensation you deserve.

An experienced attorney will understand the complexities of truck accident cases and can identify all potentially liable parties, including the truck driver, the trucking company, the truck manufacturer, and even the cargo owner. They will work diligently to hold the responsible parties accountable for their actions and fight for your rights.

In addition to the insurance coverage required by law, other potential sources of compensation may be available. For example, if the truck driver was found to be under the influence of drugs or alcohol at the time of the accident, victims may be eligible for punitive damages.

Other potential defendants may also be responsible. Punitive damages are intended to punish the at-fault party and deter similar behavior in the future.

Contact The Best 18-wheeler Accident Lawyers In Texas.

If you have been involved in an accident with a commercial vehicle like a big rig, it’s crucial to consult with a skilled personal injury attorney in Houston who has experience handling truck accident cases.

They can investigate the accident, gather evidence, and negotiate with the insurance company on your behalf to ensure you receive the full and fair compensation you deserve.

An experienced attorney will understand the complexities of truck accident cases and can identify all potentially liable parties, including the truck driver, the trucking company, the truck manufacturer, and even the cargo owner. They will work diligently to hold the responsible parties accountable for their actions and fight for your rights.

In addition to the insurance coverage required by law, other potential sources of compensation may be available. For example, if the truck driver was found to be under the influence of drugs or alcohol at the time of the accident, victims may be eligible for punitive damages.

Also, other potential defendants may be responsible. Punitive damages are intended to punish the at-fault party and deter similar behavior in the future.

Trucking Accident Claims Can Be Complex

Navigating the legal process after a truck accident can be overwhelming, especially when dealing with injuries and recovery and understanding the regulations and insurance requirements for a trucking business. That’s why it’s essential to have a knowledgeable attorney by your side, guiding you through every step of the way. They will handle all communication with the insurance company, negotiate settlements, and, if necessary, take your case to trial to ensure you receive the maximum compensation possible.

Finding a Commercial Vehicle Accident Lawyer in Texas

When searching for a top-rated personal injury attorney in the greater Houston area, there are a few key qualities to look for. First and foremost, you want an attorney who specializes in truck accident cases. These cases require specialized knowledge and expertise, so selecting an attorney with a proven track record of success in this area is crucial.

Additionally, you want an attorney who is compassionate and empathetic toward your situation. Dealing with the aftermath of a truck accident can be incredibly stressful and overwhelming, both physically and emotionally. A skilled attorney will understand the accident’s impact on your life and will be there to support you throughout the entire legal process.

Furthermore, you need an attorney who is assertive and confident in their approach. Trucking companies and their insurance providers often have teams of lawyers working to minimize their liability and payout. To level the playing field, you need an attorney not afraid to stand up to these powerful entities and fight for your rights.

Lastly, experience and communication are key. A good attorney will investigate the crash and keep you informed and updated on the progress of your case. They will promptly respond to your questions and concerns and ensure that you understand your legal options every step of the way.

Consulting with a top-rated personal injury attorney in the greater Houston area is crucial if you have been involved in a truck accident. Our truck accident lawyer has the knowledge, experience, and dedication to navigate the complexities of truck accident cases and fight for you.

6711 Cypress Creek Pkwy, Houston, TX, 77069

Visit Our Houston Law Firm

Related Resources:

- Types of Injuries from Accidents With 18-Wheelers

- Commercial Vehicle Accident Attorney in Houston

- What are my Rights After Getting Hurt in an Accident with a Commercial Vehicle?

- Understanding Commercial Vehicle Accidents

- What is the Cost to Hire a Lawyer For a Commercial Vehicle Accident?