Introduction

You’ve been in a car accident in Texas, and Farmers Insurance is involved, either as your own insurer or the other driver’s – it can feel overwhelming. We’ve put together this guide to walk you through a car accident claim with Farmers Insurance. From coping with the immediate aftermath to dealing with your insurance claim and looking after your own interests.

What to Do Right Away After the Accident Happens

Stay Safe and Get Your Story Straight

First things first, make sure everyone is safe and okay. If there has been an injury or a hazard remains on the road, call for help. Under Texas law, you are required to stop at the scene of the accident. Take some photos of the damage, the license plates, and the skid marks – or whatever else might be relevant. Texas is an at-fault state, so you’ll need to gather as much evidence as possible to figure out who’s at fault.

Exchanging Info and Keeping Evidence

Obtain the other driver’s details, including their names, contact numbers, insurance company, policy number, vehicle information, and license plate number. Don’t forget to gather some witness details and create a rough diagram of the accident while it’s still fresh in your mind. Write down what happened while the details are still clear in your head.

Get the Police Involved, or File a Report If Needed

Even if the accident doesn’t seem too serious, it’s a good idea to call the police. You’re required to report any accident that results in injury or damage over $1,000 in Texas. A police report will make the whole claims process a lot easier and give you an official record of what went down. If no one does turn up, you will need to file a Texas Peace Officer’s Crash Report (CR-2) with the Texas Department of Transportation within 10 days.

What to Do First When Filing a Claim with Farmers

Get in Touch with Farmers Right Away

There’s no specific deadline for notifying your insurance company about the accident under Texas law, but most insurance policies require you to report the incident as soon as possible. Contact Farmers and initiate your claim as soon as possible. Remember, Texas has a modified comparative negligence rule. If you’re found to be more than 51% at fault, you won’t be able to receive any compensation from the other party, so ensure you report the facts accurately.

Understand Your Coverage in Texas

Check out your Farmers policy to see what’s covered in Texas. A couple of things to think about are:

- Minimum liability requirements: Texas law requires at least 30/60/25 coverage, which means $30,000 per person for injuries, $60,000 for the entire accident, and $25,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: Get this coverage if you can afford it, but you can opt out of it in writing if you want to. Given that at least 15% of drivers in Texas are uninsured, it’s well worth having.

- Personal Injury Protection (PIP): Although not required in Texas, this coverage can help pay for medical bills regardless of who’s at fault.

Keep Everything Related to Your Claim

Keep a record of all expenses related to the accident and track all your communications with Farmers. This includes:

- Medical bills and any related records

- Vehicle repair estimates and receipts

- Any lost wages you’ve experienced

- Photos of the damage and any injuries you suffered

- A copy of the police report

Under Texas law, you’ve got two years to file a lawsuit for a personal injury claim, but don’t delay – get your claim sorted out as soon as possible.

Working with Farmers Insurance in Texas

How the Claims Process Works

Farmers will send an adjuster to investigate your claim. They will review the police report, speak with the individuals involved, and determine who was at fault under Texas’s laws. Be cooperative with the adjuster, but don’t let them talk you into saying something you’re not comfortable with. It’s always a good idea to consult an experienced lawyer before speaking to the adjuster.

Settling with Farmers

You may receive an offer from Farmers quickly, but don’t be tempted to accept it immediately. Listen to what they say, but conduct your own research and consider the information before making any decisions. Be careful, as oral settlement agreements have been held enforceable in Texas.

Your Rights Under Texas Law

Texas is an at-fault state, so the other driver’s insurance should pay for the damages. You’ve got the right to:

- Choose which repair shop to use

- Get compensation for medical bills, any lost wages, damage to your property, and any pain or suffering

- Get legal representation to look after your interests

When to Get a Lawyer on Board

You might want to think about getting a lawyer if:

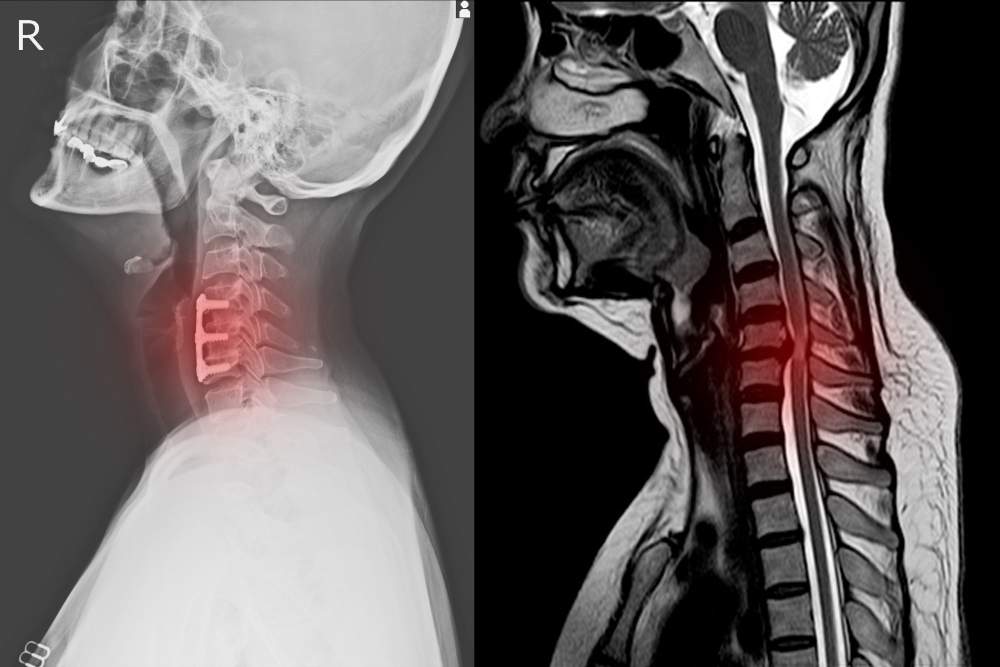

You ended up with some serious injuries and

- There’s disagreement about who’s at fault here

- The amount that Farmers is offering in settlement doesn’t seem all that reasonable

- Farmers are flat-out denying your claim

Many Texas attorneys – and this is pretty much the norm – only get paid if you get money out of the insurance company.

Contact our Houston Car Accident Lawyer for a Free Case Evaluation

If you have questions about your injury claim with Farmers Insurance, contact our Houston personal injury law firm at (281) 587-1111 for a free case review.

We have been handling injury claims with Farmers Insurance Company for over four decades, and we can likely assist you as well.

Baumgartner Law Firm

6711 Cypress Creek Pkwy, Houston, TX, 77069

(281) 587-1111