Types of Cases Handled by Personal Injury Lawyers

Discover the types of cases handled by personal injury lawyers. From car accident claims to wrongful

Types of Cases Handled by Personal Injury Lawyers

Discover the types of cases handled by personal injury lawyers. From car accident claims to wrongful

Get a thorough understanding of contributory fault in Texas. Learn about the modified comparative fa

Car Accident Settlement Timelines in Texas

Understand the car accident settlement timelines in Texas. This comprehensive guide offers detailed

Understanding Commercial Vehicles Accidents

Learn about commercial vehicle accidents and their impact. Gain valuable insights from an experience

What is Loss of Enjoyment of Life?

Learn about the loss of enjoyment of life and why it's an important factor in personal injury cases.

What to Do After a Delivery Truck Accident

Hurt in a delivery truck accident in Texas? Our experienced lawyers can help you file a claim agains

How to File a Claim Against a Trucking Company in Texas

Learn how to file a claim against a trucking company in Texas and get the compensation you deserve.

Understanding Physical Impairment in Texas

Learn about physical impairment damages in Texas and how Baumgartner Law Firm can help you seek comp

Understanding Texas Open Container Law

Discover the nuances of the Texas open container law and how it regulates the possession of alcoholi

Apartment Fire Burn Injury Lawsuits in Texas

Seeking compensation after an apartment fire? Learn about burn injury lawsuits and your legal option

Do I Really Need an Attorney for a Personal Injury Claim in Texas?

Wondering if you really need an attorney for a personal injury claim in Texas? Tips for handling a c

A Guide to Understanding the Costs of a Car Accident

Know the costs of a car accident before you get into one. Understand medical expenses, vehicle repai

Calculating a DUI / DWI Accident Settlements: A Comprehensive Guide

Discover the factors in calculating a DUI accident settlement and understand your rights to financia

What Are Economic Damages in Texas?

What are the economic damages after an accident in Texas? Find out what are economic damages and how

Concussion Effects After an Accident

Concussions & memory loss are common injuries from a car wreck. Houston auto accident attorneys can

What Are Non-Economic Damages in Texas?

What are non-economic damages in Texas- How much could you be entitled to following an accident? Lea

Negligence in Texas is a key factor in many injury cases - Discover what negligence is and how to pr

HOW MUCH IS A SETTLEMENT FOR AN 18 WHEELER ACCIDENT?

Find out how much a settlement for an 18-wheeler accident can be and the factors that impact the ave

What Does a Truck Accident Lawyer Do?

What does a truck accident lawyer do? a truck accident attorney can help you claim compensation for

Texas Car Accident Statute of Limitations

Time is of the essence - know the Texas Car Accident Statute of Limitations when filing a claim afte

Reasons to Get a Lawyer After a Car Accident

Dealing with a car accident? Find out why you should get a lawyer after a car accident to safeguard

The Process of a Wrongful Death Lawsuit in Texas

Understand the Wrongful Death Lawsuit Process in Texas & how to seek justice & compensation for a lo

Types of Damages in Personal Injury Cases in Texas

From medical bills to lost income, learn about the economic damages that may be awarded in a persona

What is Maximum Medical Improvement in Texas?

Learn about Maximum Medical Improvement in Texas and what it means for injured workers, understandin

How a Reconstruction Expert Can Help Your Case

Accident reconstruction experts can help determine cause & sequence of events. Learn how they help i

Types of Injuries from Accidents With 18-Wheelers

The different types of injuries from 18-wheeler accidents and what factors contribute to their sever

Seeing a Doctor After a Car Accident in Houston

Choose the right Houston doctor for car accident injuries. Get Seeing a Doctor After a Car Accident

Mediation in a Personal Injury Case

Mediation can help you settle a personal injury case instead of taking it to court. Baumgartner Law

Emergency Room or Urgent Care After a Car Wreck

Do you suffer from car accident injuries? Get the help you need - find out if an emergency room or u

Houston Car Accident Checklist: What You Need to Know

Baumgartner Law Firm's Houston Car Accident Checklist. Steps to take after a car accident. Protect y

Do Insurance Companies Want to Settle Injury Claims?

Learn about injury claims settlement agreement & key factors that affect the insurance company's dec

What questions should I ask my car accident lawyer?

Be prepared for a car accident case by understanding the critical questions to ask an attorney. Get

Understanding Structured Settlements: A Comprehensive Guide

Discover Structured Settlement benefits, such as tax-free income stream, customized payments and mor

Why You Need a Houston Car Crash Lawyer

After a car crash making sure you get fair compensation? Let Houston lawyer Greg Baumgartner of Baum

WHAT IS THE AVERAGE SETTLEMENT FOR A DRUNK DRIVER CASE?

The average settlement for a drunk driving accident can vary. Here is what you can do to maximize th

HOW DO I FIND THE BEST CAR ACCIDENT LAWYER NEAR ME?

Don't go through the car accident process alone. Find the best car accident lawyer near me to protec

SHOULD I GET AN ATTORNEY FOR AN AUTO ACCIDENT THAT WAS NOT MY FAULT?

Experiencing a car accident that wasn't your fault & need a lawyer? Learn the advantages of hiring a

What Is a Catastrophic Injury?

Catastrophic injuries can result in physical impairment, disability, and death - explore the legal o

Mental Anguish Damages in Texas

When you experience mental anguish due to a personal injury, Houston lawyer Greg Baumgartner helps v

Learn how to sue a daycare, including documenting injuries and gathering evidence, through our top-r

What Are Punitive Damages in Texas?

Punitive damages in Texas involve punishment for gross negligence or malice in personal injury cases

When Should I Hire a Child Injury Lawyer?

Hire a child injury lawyer when your child has been hurt by another and requires medical care to tre

What Are the Steps for Filing a Personal Injury Lawsuit in Texas?

Filing a personal injury lawsuit? Understand personal injury law and select the right lawyer. Find o

Will I Get More Settlement Money with a Personal Injury Lawyer?

Hire a personal injury lawyer to help maximize your settlement money & fight adjusters tactics. Free

Medical Evidence to Prove a Texas Personal Injury Claim

Proving the accident caused your injury is one part of the medical proof needed to win a personal in

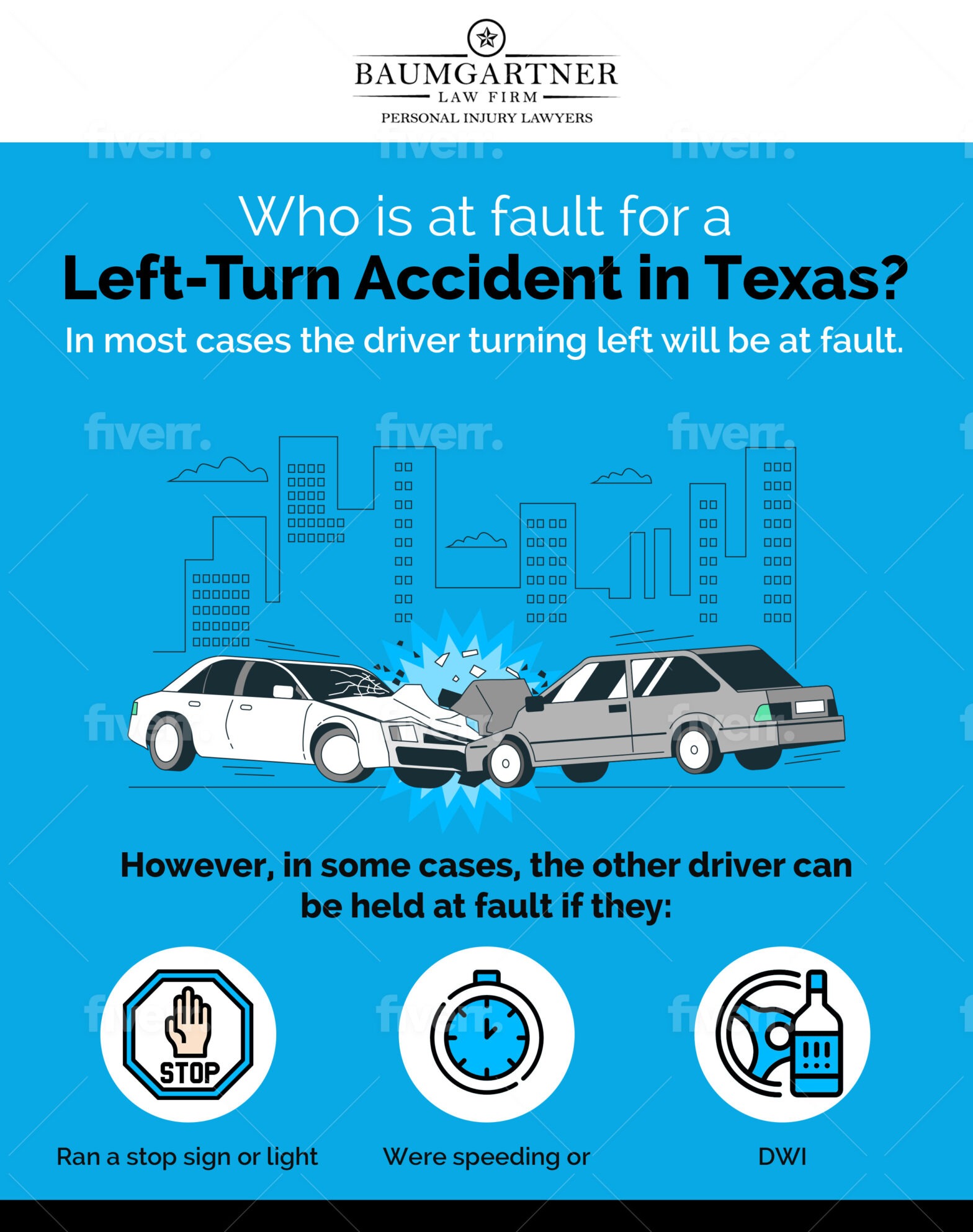

Left Turn Accidents in Texas – Whose Fault is it?

Get help from the Baumgartner Law Firm for help after a left-turn car accident in Texas. Evaluate fa

How Duty of Care Affects Negligence Claims

To get compensation on a negligence claim you must prove duty of care. Understanding duty is the fir

What to Know If You Are Hit by an Unlicensed Driver in Texas

In an accident with an unlicensed driver in Texas? Here is what you need to know to protect your rig

How Texas Car Accident Injury Claims Are Different With Company Vehicles

Accidents with company vehicles are different in Texas when making a personal injury claim. Contact

What is the legal alcohol limit in Texas?

The legal alcohol limit in Texas is 0.08% blood alcohol concentration (BAC) for individuals 21 years

Lost Wages and Diminished Earning Capacity in Texas

Looking for compensation for lost wages from a personal injury accident in Texas? A personal injury

What Does a Houston Personal Injury Lawyer Do?

Top Houston personal injury lawyer Greg Baumgartner discusses the role of a personal injury lawyer a

How Much Is My Personal Injury Case Worth?

How much a case is worth depends on many facts. Here is a guide to case evaluation in Texas personal

Tire safety tips to prevent car accidents. Knowing the signs of tire wear and when to replace your t

How Much Space You Need Between Cars at Highway Speeds?

Many people are aware that there should be enough space between the cars in front of you to create a

Why is Texting So Dangerous While Driving

Texting and driving can be deadly. Here are some alarming statistics about car accidents in Houston,

Can I Make A Personal Injury Claim If I Am Partly At Fault?

Understand how personal injury claims work in Texas when participants are partially at fault for an

Can I Fire My Personal Injury Attorney

Can you change personal injury attorneys? Find out what to consider before deciding. And if it’s b

The Dangers of Riding a Motorcycle in Houston

Houston is one of the most deadly cities in the country for motorcycle riders. Here are some motorcy

Suing Bars and Clubs For Over Serving

Bars can be legally responsible for overserving patrons under specific circumstances, here is an ove

Burn Injury Verdicts and Settlements

Burn injury due to negligence of another can lead to substantial compensation if you choose the righ